Walkthrough: How to Complete Your Vacant Unit Tax (VUT) Declaration Online

- Crista Cooper

- 41 minutes ago

- 3 min read

This step-by-step guide walks residents through the online Vacant Unit Tax (VUT) declaration process, from registering for the My.Hamilton portal to successfully submitting their annual declaration.

If you prefer video instructions, a full walkthrough is also available here:

Video walkthrough:

Download SIMPLE Walkthrough instructions

Download Detailed Walkthrough with pictures

Before You Begin

You will need:

Your Notice to Declare letter from the City of Hamilton

Your Roll Number (do not include the last four zeros)

Your Access Code (note that the number 1 may appear similar to the letter “I”, and the number 0 may look like the letter “O”)

An email address to register for My.Hamilton

Step 1: Register for the My.Hamilton Portal

If you already have a My.Hamilton account, you can skip this step.

1. Visit the My.Hamilton Portal

Go to: https://my.hamilton.ca

Click “Sign up now.”

2. Enter Your Email Address

.

Enter your email address

Click “Send Verification Code”

You will receive a verification code by email within approximately 5 minutes.

Tip: If you do not receive the email, check your junk or spam folder. You can also click “Send New Code” to try again.

3. Verify Your Email

Enter the verification code from your email

Click “Verify Code”

4. Create Your Password

Your password must:

Be between 8 and 64 characters

Include at least three of the following:

Lowercase letter

Uppercase letter

Number

Symbol

Enter your password and click “Create.”

5. Complete Your Profile

Enter your First Name and Last Name

Mobile number is optional

Click “Update”

You are now registered for My.Hamilton.

Step 2: Complete Your Vacant Unit Tax Declaration

Once registered, you will use the My.Hamilton portal each year to submit your VUT declaration.

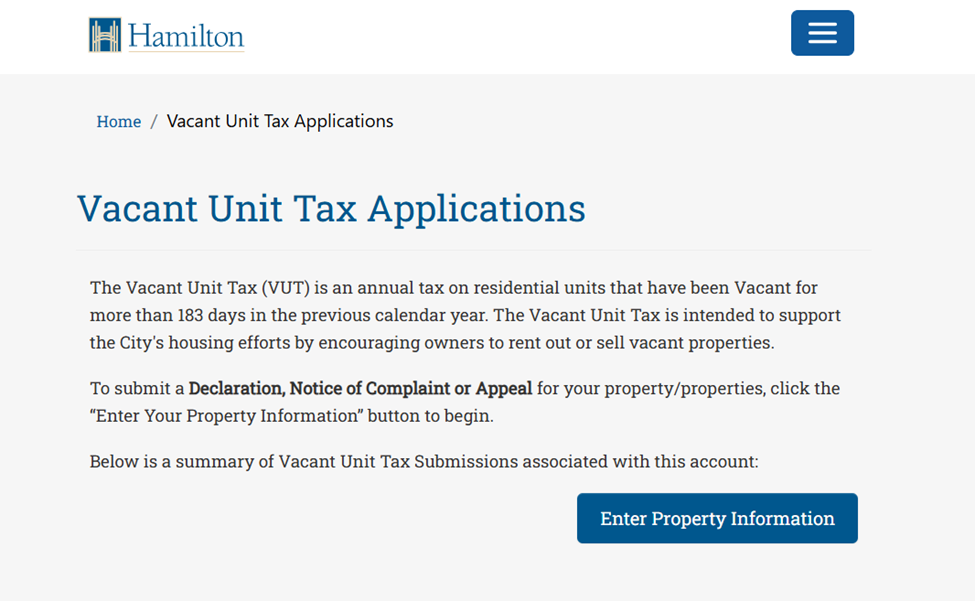

1. Access the Vacant Unit Tax Application

Log in to My.Hamilton

Click the “Vacant Unit Tax” button

2. Enter Property Information

Click “Enter Property Information”

Review the Notice of Collection

Click “Start”

3. Enter Roll Number and Access Code

Enter your Roll Number (without the last four zeros)

Enter your Access Code

Select 2025 from the Occupancy Year dropdown

Click “Verify”

4. Confirm Property Information

Review the property details shown on screen

If correct, click “Confirm and Continue”

If not, select “Previous” to make corrections

5. Identify Your Role

From the dropdown menu, select whether you are:

The Property Owner, or

Submitting On Behalf of the Property Owner

Click “Next.”

6. Declare Occupancy Status

For each unit:

Click “View / Edit Unit Details”

Select the appropriate Occupancy Type

Click “Submit”

Repeat this step for all units or properties listed.

7. Review and Submit

Confirm that the occupancy status for all units is correct

Review the summary page

Check the box confirming the information is accurate

Click “Submit”

Confirmation

Once submitted, your annual Vacant Unit Tax declaration is complete.

You will receive a confirmation email.

Important Dates

Declaration Period Opens: December 17, 2025

Deadline: April 15, 2026

Late Declaration Deadline: May 15, 2026 (late fee applies)

Need Help?

If you experience any issues or have questions:

Email: vacantunittax@hamilton.ca

Phone: 905-546-2573

Declarations can also be completed by phone, email, mail, or in person at a Municipal Service Centre.

Download the Physical Declaration form

Online Declarations

Visit my.hamilton.ca to complete your declaration.

If you have any issues completing your declaration, please contact the Vacant Unit Tax team by email at vacantunittax@hamilton.ca or by phone at 905-546-2573.

Declaration by Phone

Declarations can also be submitted by calling 905-546-2573. Note: Long distance charges may apply for calls outside of Hamilton. Please check with your telephone service provider.

Declaration by Email, Mail or In-person

Email - Send completed form to vacantunittax@hamilton.ca

Mail or In-person - Printed declaration forms will be accepted in person at any Municipal Service Centre, or by mail to

Vacant Unit Tax

71 Main Street West

Hamilton, ON, L8P 4Y5

You can schedule an in-person appointment by phone at 905-546-2573.

To receive a declaration submission confirmation, all sections of the declaration form must be completed and signed. Declaration confirmations will be sent by email (if an email is provided on the form).

Consequences of Non-Submission

If a mandatory declaration is not submitted by the late declaration deadline of May 15, 2026, the residential unit will be considered vacant, and the Vacant Unit Tax will be charged.

Looking Ahead

Planned improvements to the online declaration process are expected in Q1 2026 as part of the City’s My.Hamilton platform enhancements, making future submissions faster and easier.

Stay tuned for updates.

Comments